ACCESSING Your 2023 CLIENT ORGANIZER

Your Client Organizer is the important first step in analyzing your tax position for the year. Our online version is designed to help you quickly and conveniently provide us with critical information to maximize your deductions and minimize the hassles.

How to Access your Client Organizer/Upload Documents

Follow the steps below to access your 2023 tax organizer via our client center.

Step 1: Login

- Select Client Login in the upper right-hand corner

- Enter your Username and password

- You will be required to Upgrade your NetClient CS Login

- Click on this link to see step-by-step instructions for setting up two-factor authentication for your account (the Multi-Factor Authentication (MFA) will no longer be used to access your portal).

- Click here for Two-factor authentication help center.

- Watch this video for better understanding and assistance Migrating Your NetClient CS Account

Note: If you forgot your password, click the forgot password link. Enter your Login and the email associated with your login. Click continue and it will send a temporary password to your email. If any assistance is needed with Upgrading your Thomson Reuters portal login and password call Rosie Rivera at (630) 717-5330.

- Select the orange Tax Org rectangle next to your name (as shown here) Tax Org

- Click on the Questionnaire folder

- Click on the Web Questionnaire to answer ALL questions

- Save & Close

- Note: Do not click on the Send to Preparer icon until you are completely done answering all questions and uploading all or most of your documents because you will not be able to go back once you click on the Send to Preparer. (see Step 3)

Step 3: UPLOADING YOUR TAX DOCUMENTS

- Click on the Upload Tax Documents (As shown here in your Tax Organizer Index.)

- Click on Upload

- Click Add files

- Choose ALL the files you’re sending with your Organizer.

- Start Upload (You will see the documents in the Upload box)

- Once you have completed both the Questionnaire and tax documents,

- Click on Send to Preparer (as shown here). Clicking on the Send to Preparer icon can only be done one time.

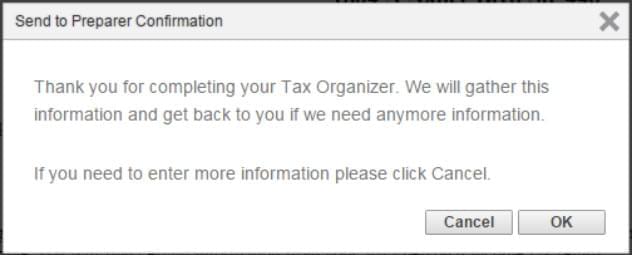

- You will see a “Send to Preparer Confirmation” window on your screen (see below). If you need to enter more information please click CANCEL, if not, click OK and you are finished!

OR

PRINTING YOUR CLIENT ORGANIZER TO COMPLETE BY HAND

- Click on the CREATE pdf icon (as shown here).

- Print the pdf or save to your computer

- Complete questionnaire by hand